Condo Insurance in and around Horseheads

Horseheads! Look no further for condo insurance

State Farm can help you with condo insurance

- Horseheads

- Elmira

- Big Flats

Condo Sweet Condo Starts With State Farm

Often, your home base is where you are most able to slow down and enjoy family and friends. That's one reason why your condo means so much to you.

Horseheads! Look no further for condo insurance

State Farm can help you with condo insurance

Agent Brian Stein, At Your Service

You want to protect that meaningful place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as vandalism, smoke or fire. Agent Brian Stein can help you figure out how much of this wonderful coverage you need and create a policy that has what you need.

Ready to take the next step? Agent Brian Stein is also ready to help you see what customizable condo insurance options work well for you. Call or email today!

Have More Questions About Condo Unitowners Insurance?

Call Brian at (607) 739-3589 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

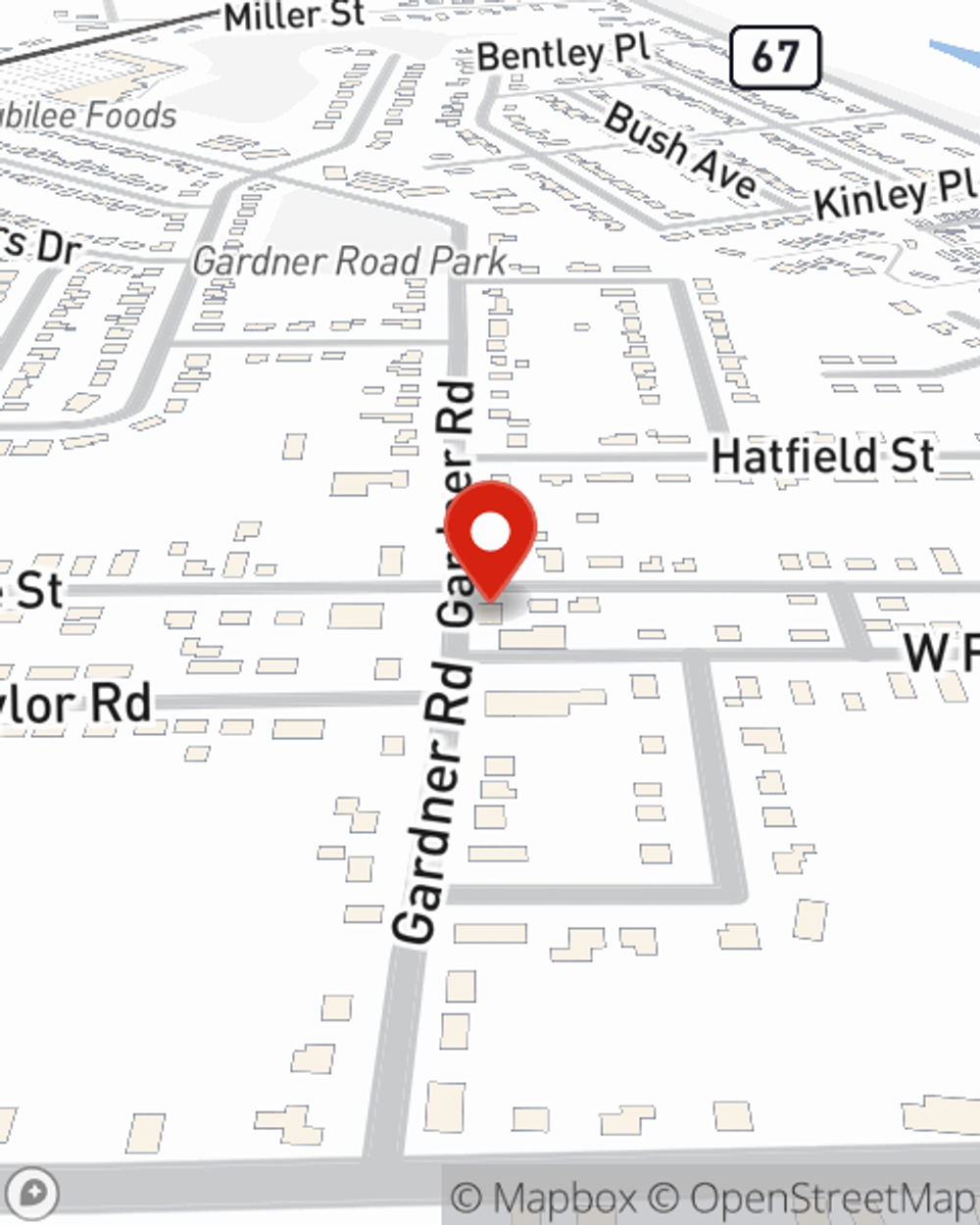

Brian Stein

State Farm® Insurance AgentSimple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.